Every family dream of having a car of their own and moreso, a house where they can build a happy home. The sad thing is that not every Filipino family has the means to make it happen. Even overseas Filipino workers who dream of these things may need the help of financial institutions where they can get a housing or mortgage loan but requirements are not easy and the interest rates are still heavy to bear. Some banks offer loans that are not too heavy for typical family budget allowing these dreams to become a reality.

Advertisement

Sponsored Links

Auto Loan

First, let us give answers to the commonly asked questions about the UnionBank Auto loan.

1. What type of cars can you purchase?

UnionBank Auto Loans will help you purchase brand new or second-hand cars or brand new light trucks.

2. Are you eligible to get a UnionBank auto loan?

Yes, if you are between 21 to 65 years old with a total monthly income of P50,000. Foreign nationals married to a Filipina or business entities like corporations and partnerships may also apply for an auto loan.

The client must be 65 years old upon maturity of the loan.

3. What do you need to submit when you apply for a UnionBank auto loan?

If you are employed, you will need to submit the following:

COE - Certificate of employment with compensation

Latest Income Tax Return (ITR)*

Completely filled up application form, or apply online

* ITR is not required for loan amounts below P3,000,000

If you are self-employed, you will need to submit the following:

Business Registration papers (DTI, SEC if applicable)

ITR with audited financial statements (2 years)

Trade references

Completely filled up application form

4. How can you pay for your loan?

Auto Debit Arrangement (ADA) - Automatically deducted from your account. You may open a Checking or Savings Account with us with no maintaining balance; or a Debit GetGo Card.

Postdated Checks (PDC)

5. Post Booking FAQs

For booked accounts, If you have any concerns about your existing account with us, you may call (02) 841-8600 or email them at autoloans@unionbankph.com

Before making an auto loan you will be asked to complete a self-assessment that looks exactly like the image below.

You may need to fill-up this form legibly and correctly during your application.

To know how much you will need for the auto loan, they provide a calculator on their website that looks like the image below. You may choose any of the provided preference for your dream car.

Home Loan

First, let us give answers to the commonly asked questions about the UnionBank Auto loan.

1. What type of cars can you purchase?

UnionBank Auto Loans will help you purchase brand new or second-hand cars or brand new light trucks.

2. Are you eligible to get a UnionBank auto loan?

Yes, if you are between 21 to 65 years old with a total monthly income of P50,000. Foreign nationals married to a Filipina or business entities like corporations and partnerships may also apply for an auto loan.

The client must be 65 years old upon maturity of the loan.

3. What do you need to submit when you apply for a UnionBank auto loan?

If you are employed, you will need to submit the following:

COE - Certificate of employment with compensation

Latest Income Tax Return (ITR)*

Completely filled up application form, or apply online

* ITR is not required for loan amounts below P3,000,000

If you are self-employed, you will need to submit the following:

Business Registration papers (DTI, SEC if applicable)

ITR with audited financial statements (2 years)

Trade references

Completely filled up application form

4. How can you pay for your loan?

Auto Debit Arrangement (ADA) - Automatically deducted from your account. You may open a Checking or Savings Account with us with no maintaining balance; or a Debit GetGo Card.

Postdated Checks (PDC)

5. Post Booking FAQs

For booked accounts, If you have any concerns about your existing account with us, you may call (02) 841-8600 or email them at autoloans@unionbankph.com

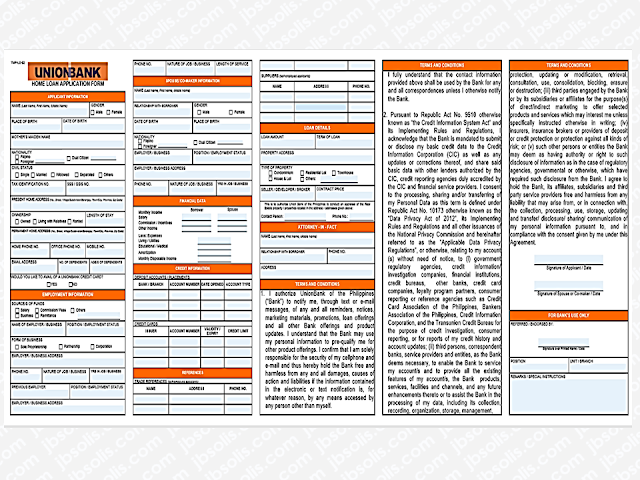

Before making an auto loan you will be asked to complete a self-assessment that looks exactly like the image below.

You may need to fill-up this form legibly and correctly during your application.

To know how much you will need for the auto loan, they provide a calculator on their website that looks like the image below. You may choose any of the provided preference for your dream car.

Home Loan

Who are qualified to apply for UnionBank’s Home Loans?

Individuals who are gainfully employed and with permanent status

Individuals engaged in own business operating profitably for at least 2 years or a partner in a registered ownership

Must be of legal age, not more than 65 years old upon application and must not exceed the age of 70 years upon loan maturity

Must have a good credit standing

What type of loan can you avail of?

We are committed to helping you purchase your own lot, townhouse, residential condominium or house and lot from our Accredited Developers.

Our minimum loanable amount is P500,000.00, while the maximum loanable amount is up to 90% of the property’s selling price.

What is the maximum term for your home loan?

Maximum of 20 years for locally employed

Maximum of 15 years for OFWs

What documents do you need to submit?

Personal Data Documents

Duly filled out Application form

Photocopy of Marriage Contract (if applicable)

Photocopy of any government-issued ID with picture and signature

Income Documents

For locally employed applicants:

Certificate of Employment

3 months latest pay slips

If Overseas Filipino Worker (OFW):

Original Consularized Special Power of Attorney (SPA)

Passport with entry and exit stamps

For self-employed applicants:

Business Registration

Latest 6 months Bank Statements

Financial Statements

ITR

Top 3 list of suppliers/customers with contact numbers (landline)

Collateral Documents

Contract to Sell or Reservation Agreement

Statement of Account

What are the interest rates?

Each rate is fixed to their corresponding period.

RatePeriod

6.50% 1 year

7.50% 3 year

8.50% 5 year

10.50% 10 year

11.50% 15 year

Real Estate Mortgage Fees and Charges

Fees and ChargesReal Estate Mortgage Fees

Registration Fees Fees collected relating to the registration of TCT with Register of Deeds and are computed by the RD based on loan amount

6.50% 1 year

7.50% 3 year

8.50% 5 year

10.50% 10 year

11.50% 15 year

Real Estate Mortgage Fees and Charges

Fees and ChargesReal Estate Mortgage Fees

Registration Fees Fees collected relating to the registration of TCT with Register of Deeds and are computed by the RD based on loan amount

Bank Charges

Processing Fee P3,500 Metro Manila; P4,000 outside Metro Manila

Appraisal Fee P3,500 Metro Manila; P4,000 outside Metro Manila

Other Charges

Documentary Stamps Tax collected on legal instruments, loan agreements and other documents which are remitted to Bureau of

Documentary Stamps Tax collected on legal instruments, loan agreements and other documents which are remitted to Bureau of

Internal Revenue (BIR)

REM-Doc Stamp P20 for the 1st P5,000 & P10 for succeeding P5000

PN-Doc Stamp P1 for every P200 or a fraction thereof or P1,160,000 / 200 = P5,800

REM-Doc Stamp P20 for the 1st P5,000 & P10 for succeeding P5000

PN-Doc Stamp P1 for every P200 or a fraction thereof or P1,160,000 / 200 = P5,800

Mortgage Redemption Insurance Form of life insurance that pays off borrower or the whole of the insured's outstanding mortgage balance in case of death or total disability Loan Amount / 1,000 x (standard rate)

Fire Insurance Insurance that provides protection to your house against loss or damage caused by fire and is computed by the Fire Insurance provider

Notarial Fee Individual Account P400; Developer P800

Amendment Fees and Penalties

Full or partial payments made outside the anniversary date of the loan P4,000

Request for shortening or extension of term P4,000 (shortening) P4,200 (extension)

Full or partial payments made outside the anniversary date of the loan P4,000

Request for shortening or extension of term P4,000 (shortening) P4,200 (extension)

Cancellation of Mortgage (for fully paid accounts) P500

Delinquent Interest on unpaid balance (for fully paid accounts) Delinquent interest (interest rate per PN or the repriced interest) and penalty (36%) on unpaid monthly installment

Accredited Developers

Aboitiz Land

Brittany

Camella

Century properties

Crown Asia

DMCI

Empire East

Federal Land

Filinvest

Greenfield

Megaworld

Robinsons Land

Rockwell Land

Shang Properties

SMDC

Suntrust

Vista Residences

You can pay your loan by using these two options:

—Auto Debit Arrangement (ADA) - Automatically deducted from your account. You may open a Checking or Savings Account with us with no maintaining balance,; or a Debit GetGo Card.

—Postdated Checks (PDC)

You may need to fill the application correctly and legibly.

You may need to fill the application correctly and legibly.

Salary loan is also available but it is only offered to the existing Union Bank clients.

For further information, visit their official website or you can go to their nearest branch within your locality.