ONLINE BANKING

Before mobile banking, online banking - through the use of a computer - is the most modern way to do banking. One simply has to login to the bank's website and do transactions as needed (except to withdraw or deposit money, of course). Granted the convenience, internet banking has it's own share of risks. Because a computer is vulnerable to hacking, phishing, virus, trojans and other means of attacks, here are the things you must take note to keep safe.

This would be the easiest way to protect your password from being recorded by key-loggers, especially when using computers in a public setting - internet cafe or offices.

MOBILE PHONE BANKING:

CHECK THAT APP:

Download your banking application on the mobile device instead of using the mobile browser to conduct mobile banking. If your bank's app is not available, use a secure browser, especially on Android phones. Also, get software updates to avoid exploitation of software loopholes.

Some malware may pose as a legitimate bank application. Make sure you are using the official one, by comparing with friends, or inquiring at the bank itself. Most banks provide a guide or link to their official app on the bank's website itself.

CHECK YOUR OTHER APPS:

Be wary of the apps you keep on your device along with your banking apps. Check the app permissions in the application settings to be sure that other apps, especially free ones, are NOT getting unnecessary access to your smart phone. Here's how you do it in Android and iPhone.

NUCLEAR OPTION - WIPE!

Ensure that your mobile device has remote wipe installed or enabled. This is so that if your phone gets stolen or you lose your phone, you can delete all information you had stored within - including your banking application. Notify your bank about the situation so that no texts or mails will be sent to your mobile device.

LOCK OR SWIPE?

Always lock your phone when not using it to prevent unauthorized user access. Even a child fiddling your phone can cause problems with your banking app. Check your phone settings and enable the auto-lock feature. Put a pin or pattern, or enable the fingerprint lock/unlock feature to secure the device from others. This will also buy you some time in case your phone gets stolen.

GENERAL SAFETY:

FREE WIFI!

Refrain from using public wireless networks to do your banking, whether via laptop or smartphone. They are unsecured and hackers often lay traps using such networks. Connect only through secured or private wireless network. Also, do not connect your phone to another device when banking.

STAY ALERT:

Be aware of your surroundings. Never do online banking transactions in an internet cafe, or even at Starbucks. They may be secured by the shop, but who knows if there is someone using the same WiFi network and skimming the information from other users.

Always check your banking transaction history and account statements on a regular basis. Check for unauthorized transactions or transactions that you do not remember doing. Inform the bank about irregular things that you notice, even if you are unsure.

INQUIRE and SUBSCRIBE:

Inquire and subscribe to Two-factor Authentication or One-time-password facility whenever possible, be it to change your net banking pin, make a transaction or add a third-party account. This would require you to enter a one-time code, usually sent via sms to your registered phone, whenever you login and transact online.

Before mobile banking, online banking - through the use of a computer - is the most modern way to do banking. One simply has to login to the bank's website and do transactions as needed (except to withdraw or deposit money, of course). Granted the convenience, internet banking has it's own share of risks. Because a computer is vulnerable to hacking, phishing, virus, trojans and other means of attacks, here are the things you must take note to keep safe.

USE ON-SCREEN KEYBOARD:

A key-logger, can be hardware or a software installed on the computer. It records the keyboard entries you make. Using this information, it would be easy to find your username and password. While software loggers are hard to spot, hardware loggers will have to be an attachment to the terminal. However, know that an on-screen keyboard is not fool-proof by itself.

DO NOT FOLLOW LINKS:

Always type in the web address (URL) to access your bank's website. Never click on a link from an e-mail you get, even if it looks like it came from the bank. That is how 'phishers' work, they re-direct you to a fake website site resembling your bank's website and use the information provided by you (username and password) to access your account.

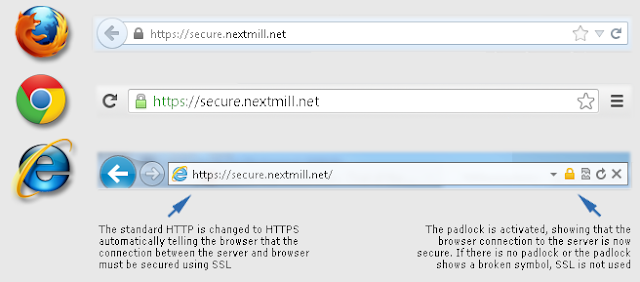

The login page of bank website is secured through an encryption process, so a locked padlock or unbroken key symbol should appear in your browser window when accessing your bank's site.

Also, the beginning of your bank's internet address will change from 'http' to 'https' when a secure connection is made. Be wary of suspicious pop-ups that appear during your banking session. Log out immediately. Don't, in response to any mail, provide your banking user ID, passwords or credit and debit card numbers.

CLEAN YOUR CACHE:

Browsers save pages you have viewed on your computer so that it can be accessed quicker if you wish to view it again, such as when you use the 'back' button. By clearing your browsing data or cache after visiting your net banking account, you make sure no one else can view the confidential information you have viewed.

Also, don't select the option on the browser that stores or retains user name and password, i.e. auto complete or auto save password. It wouldn't take too long for a program to get that information from your browser. Or worse, the guy who will use your computer next can login to your account because you saved the password in the internet browser.

UPDATE AND BE SECURE:

Keep your operating system and browser up-to-date with the latest security updates. Install these only from a trusted website or let the application update automatically by schedule.

Also, a computer running on a big network, is likely to be much safer than your home PC. Its level of security can be measured by how strict the limitations are on its use. However, you will have to trust your network manager to not access records of your online activity.

MOBILE PHONE BANKING:

CHECK THAT APP:

Download your banking application on the mobile device instead of using the mobile browser to conduct mobile banking. If your bank's app is not available, use a secure browser, especially on Android phones. Also, get software updates to avoid exploitation of software loopholes.

Some malware may pose as a legitimate bank application. Make sure you are using the official one, by comparing with friends, or inquiring at the bank itself. Most banks provide a guide or link to their official app on the bank's website itself.

CHECK YOUR OTHER APPS:

Be wary of the apps you keep on your device along with your banking apps. Check the app permissions in the application settings to be sure that other apps, especially free ones, are NOT getting unnecessary access to your smart phone. Here's how you do it in Android and iPhone.

NUCLEAR OPTION - WIPE!

Ensure that your mobile device has remote wipe installed or enabled. This is so that if your phone gets stolen or you lose your phone, you can delete all information you had stored within - including your banking application. Notify your bank about the situation so that no texts or mails will be sent to your mobile device.

LOCK OR SWIPE?

Always lock your phone when not using it to prevent unauthorized user access. Even a child fiddling your phone can cause problems with your banking app. Check your phone settings and enable the auto-lock feature. Put a pin or pattern, or enable the fingerprint lock/unlock feature to secure the device from others. This will also buy you some time in case your phone gets stolen.

GENERAL SAFETY:

FREE WIFI!

Refrain from using public wireless networks to do your banking, whether via laptop or smartphone. They are unsecured and hackers often lay traps using such networks. Connect only through secured or private wireless network. Also, do not connect your phone to another device when banking.

S+R0nG P@ssWoRdS:

Use a combination of random letters and numbers because password-cracking programs check for dictionary words, names and phrases. One way to create a strong yet easy to recall password would be to remember a familiar sentence and use the first letter of each word to form the password. Try using a sentence that can have a number in between.

For example, the sentence my car Toyota Fortuner is a model '16 will give you a password of mcTFiam'16 . You can use any sentence that is not generic. Try inserting symbols and capitalizing some letters (not necessarily the first) to improve password strength.

There are other ways of creating strong passwords, like Character Substitution - replacing the alphabet with familiar characters: @ = a, 8 = b, 1 = l, 5 = s, and so on.

5@mp1e = sample

Change your password using a secure computer (at home) is a good practice if you just recently used a public computer to access you online accounts. If you want to check the strength of your password, check it up here!

PRIVACY:

Do not disclose your personal information to anyone, including your account numbers, your parents' middle name (a common security question in phone transactions), your mobile number, or your ID numbers - unless the person is from the bank whom you called (not the other way around).

A new form of hackers called "social hackers," gather sensitive information by calling people, pretending to be from the bank or any other institution with interest in your finances. Once they get enough information, they will use your identity to steal your money from the bank.

STAY ALERT:

Be aware of your surroundings. Never do online banking transactions in an internet cafe, or even at Starbucks. They may be secured by the shop, but who knows if there is someone using the same WiFi network and skimming the information from other users.

Always check your banking transaction history and account statements on a regular basis. Check for unauthorized transactions or transactions that you do not remember doing. Inform the bank about irregular things that you notice, even if you are unsure.

INQUIRE and SUBSCRIBE:

Inquire and subscribe to Two-factor Authentication or One-time-password facility whenever possible, be it to change your net banking pin, make a transaction or add a third-party account. This would require you to enter a one-time code, usually sent via sms to your registered phone, whenever you login and transact online.

source: Business Today, BBC

©2017 THOUGHTSKOTO

SEARCH JBSOLIS, TYPE KEYWORDS and TITLE OF ARTICLE at the box below