ATM Skimming is a modus operandi where criminals use an “ATM skimmer” - a malicious device attached to an ATM - to steal your money. When you use a compromised ATM machine, the skimmer will copy the information in your card's magnetic strip. A hidden camera or a fake keypad will then capture your PIN as you enter it.

If you use ATMs often, then you should be aware of these high tech method criminals use to steal your money easily. It’s used to be easy to spot ATM skimmers. But with improving technology, including 3D printing, skimming devices are getting harder to detect. The best you can do is to protect your PIN so ATM skimmers won’t be able to capture it.

If you use ATMs often, then you should be aware of these high tech method criminals use to steal your money easily. It’s used to be easy to spot ATM skimmers. But with improving technology, including 3D printing, skimming devices are getting harder to detect. The best you can do is to protect your PIN so ATM skimmers won’t be able to capture it.

How ATM Skimmers Work

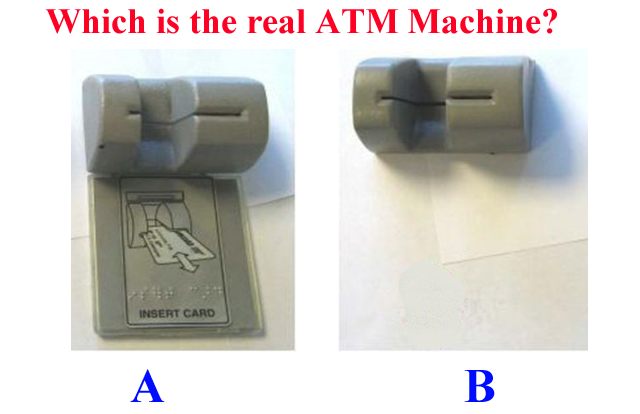

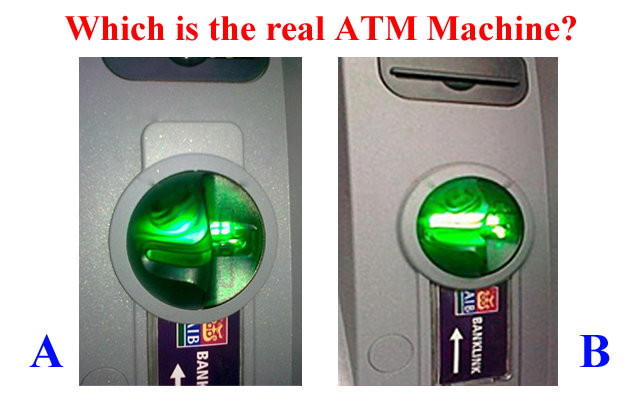

An ATM skimmer has two components. The first is a small device that’s generally inserted over the ATM card slot. When you insert your ATM card, the device creates a copy of the data on the magnetic strip of your card. The card passes through the device and enters the machine, so everything will appear to be functioning normally –but your card data has just been copied.

The second part of the device is a small camera. A pinhole camera is placed at the top of the ATM’s screen, just above the number pad, or to the side of the pad. The camera is facing the keypad and it captures you entering your PIN.

The ATM appears to be functioning normally, but the attackers just copied your card’s magnetic strip and your PIN.

The attackers can use this data to clone your ATM card and use it in ATM machines, entering your PIN and withdrawing money from your bank accounts.

ATM skimmers are becoming more and more sophisticated. Instead of a device fitted over a card slot, a skimmer may be a small, unnoticeable device inserted into the card slot itself.An ATM skimmer has two components. The first is a small device that’s generally inserted over the ATM card slot. When you insert your ATM card, the device creates a copy of the data on the magnetic strip of your card. The card passes through the device and enters the machine, so everything will appear to be functioning normally –but your card data has just been copied.

The second part of the device is a small camera. A pinhole camera is placed at the top of the ATM’s screen, just above the number pad, or to the side of the pad. The camera is facing the keypad and it captures you entering your PIN.

The ATM appears to be functioning normally, but the attackers just copied your card’s magnetic strip and your PIN.

The attackers can use this data to clone your ATM card and use it in ATM machines, entering your PIN and withdrawing money from your bank accounts.

Instead of a camera pointed at the keypad, the attackers may be using an overlay — a fake keyboard fitted over the real keypad. When you press a button on the fake keypad, it logs the button you pressed and presses the real button underneath. These are harder to detect. Unlike a camera, they’re also guaranteed to capture your PIN.

|

| A compromised ATM Machine found in BPI Bank, Philippines. |

ATM skimmers generally store the data they capture on the device itself. The criminals have to come back and retrieve the skimmer to get the data it’s captured. However, more ATM skimmers are now transmitting this data over wireless devices like Bluetooth or even cellular data connections.

How to Spot ATM Skimmers

Basic Security Precautions

here’s what you should always do to protect yourself when using any ATM machine:

Check around the ATM Machine, if there are any devices like modems or routers hidden beside or behind the machine.

- Take a quick look at the ATM machine. Does anything look a bit out-of-place? Perhaps the bottom panel is a different color or looks new compared to the rest of the machine because it’s a fake piece of plastic placed over the real bottom panel and the keypad. Perhaps there’s an odd-looking object that contains a camera. Are there visible traces of glue, tape or other sticking materials around edges?

|

| A compromised ATM Machine with a card skimmer and a concealed mobile phone overhead as a camera. |

- Jiggle the Card Reader: If the card reader moves around when you try to jiggle it with your hand, something probably isn’t right. A real card reader should be attached to the ATM so well that it won’t move around — a skimmer overlaid over the card reader may move around.

- Examine the Keypad: Does the keypad look a bit too thick, or different from how it usually looks if you’ve used the machine before? Does it look too clean or too new compared to the machine itself? Normal wear and tear usually makes the keypad dirty and the numbers faded out. A good looking and spotless keypad may be an overlay over the real keypad.

Basic Security Precautions

here’s what you should always do to protect yourself when using any ATM machine:

- Avoid using machines in places that are dark, rural, and with very few to no people around.

- ATMs within the bank premises are generally more safe than those found elsewhere, but this is not always the case. ATMs in malls are also usually safe, unless the location is in a corridor far from view of the people.

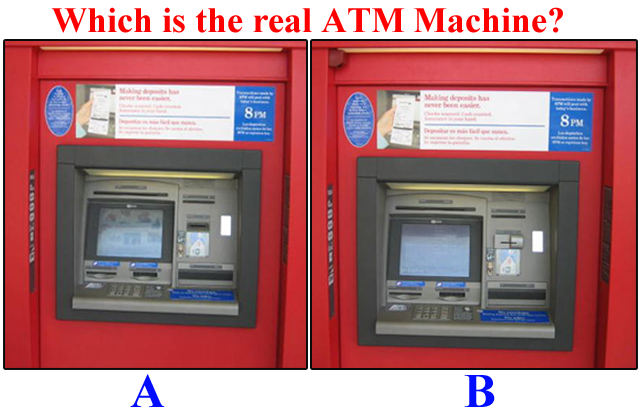

- If you can, check and compare the ATM you are using with the one beside it, to see any difference. If you find some unusual differences, be safe and find another machine.

- Shield Your PIN With Your Hand, bag or wallet. Learn how to enter the PIN without looking at the pad. This might not protect you against the most sophisticated skimmers that use keypad overlays, but you’re much more likely to run into an ATM skimmer that uses a camera — they’re much cheaper to purchase. This is the easiest tip you can use to protect yourself.

|

| Covering the keypad by your hand is the simplest but most effective way of protecting your ATM information and your money. |

- Monitor Your Bank Account Transactions: You should regularly check your bank accounts and credit card accounts online. Check for suspicious transactions and notify your bank as quickly as possible. You want to catch these problems as soon as possible — don’t wait until your bank mails you a printed statement a month after money has been withdrawn from your account by a criminal.

- If your bank has it, subscribe to SMS notifications, whereby you will receive a text message each time a withdrawal or deposit is made on your account.

- If you suspect that an ATM machine is compromised, report it to the bank or nearest police station.

Skimming usually happens around salary and bonus dates, holidays, and days when people usually spend money (school enrollment, bills payment). ATMs in remote areas or areas with very few people are often chosen by criminals to install their skimming devices. ATMs in tourist spots are also more common since people using ATMs here are not locals.

Now that you have an idea about skimming, test yourself with these images. Which of these are compromised and which ones are real and safe to use?

Scroll down to get the correct answers.

source: howtogeek

The Philippines' Golden Age of Infrastructure

Job Hunting in The Philippines Gets Even Tougher; List Of Job Fair Venues This Coming Labor Day

OFWs In Saudi Arabia Are Now Limited To Having Only Two SIM Cards

Job Hunting in The Philippines Gets Even Tougher; List Of Job Fair Venues This Coming Labor Day

OFWs In Saudi Arabia Are Now Limited To Having Only Two SIM Cards

The real ATM Machines above are options A, B, B and A.

©2017 THOUGHTSKOTO

SEARCH JBSOLIS