Life insurance is pricey, in fact there are only few Filipinos who care to secure themselves with life insurance.

But do you know that there are some banks in the Philippines that offers FREE life insurance when you choose to open an account with them?

If you will ask me, I prefer not to invest money in banks, because of very low interest rate. Savings account usually give around 0.5% interest while time deposit has around 1% interest depending on the term and amount of deposit.

I did not really gave so much time as to the kinds of savings account or deposit accounts offered by different banks. But, while checking the banks in Philippines, we found out that there are savings account that actually includes life insurance coverage. And they don't charge you for anything. Here are some options you might want to check out. So that while your money is at the bank, you could get some form of insurance in case something happens to you.

I did not really gave so much time as to the kinds of savings account or deposit accounts offered by different banks. But, while checking the banks in Philippines, we found out that there are savings account that actually includes life insurance coverage. And they don't charge you for anything. Here are some options you might want to check out. So that while your money is at the bank, you could get some form of insurance in case something happens to you.

|

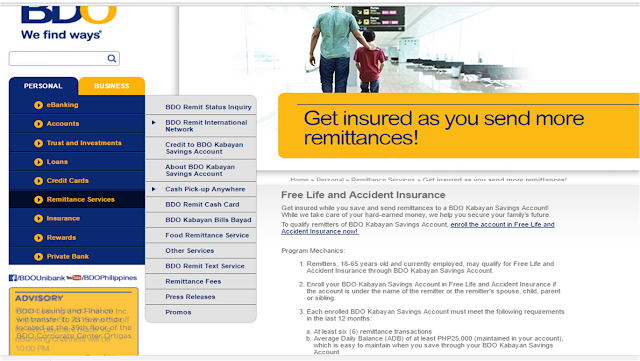

| BDO Kabayan Account Offers FREE LIFE INSURANCE.

KABAYAN SAVINGS FREE LIFE AND ACCIDENT INSURANCE

MECHANICS

1. Ang remitter na 18 to 65 years old at kasalukuyang

nagtatrabaho ay maaaring magkaroon ng Insurance sa pamamagitan ng BDO Kabayan

Savings Account.

2. Maaari mong i-enroll ang BDO Kabayan Savings Account sa

Free Life and Accident Insurance kung ang account ay pagmamay-ari ng remitter,

o ng kanyang asawa, anak, magulang o kapatid.

3. Ang bawat enrolled BDO Kabayan Savings Account ay

kailangang ma-meet ang mga sumusunod sa nakalipas na 12 buwan:

a) May

anim (6) o higit pang remittance transactions

b) May

Average Daily Balance (ADB) na at least PHP 25,000.

Madaling

maaabot ito kung nag-iipon sa BDO Kabayan Savings Account. May insurance

coverage na ang remitter sa bawat buwan na ma-meet ang requirements.

4. Ang insured amount ay 50% ng ADB at 50% ng total

remittances sa nakalipas na 12 buwan ngunit hindi hihigit sa PHP 1 million*

bawat remitter.

*Maximum benefit amount of PHP 1MM for natural death at PHP

2MM para sa accidental death.

The Free Life and Accident Insurance is underwritten by

Generali Pilipinas Life Assurance Company, Inc. / Generali Philippines. It is

not a bank deposit or obligation of, or guaranteed by BDO Unibank, Inc. (BDO)

or the Philippine Deposit Insurance Corporation. BDO is not in the business of

offering or issuing insurance and nothing in this form shall be interpreted as

to acknowledge that BDO engages in the insurance business.

The Free Life and Accident Insurance is given in the

Philippines.

Free Life and Accident Insurance

The BDO Kabayan Account gives FREE life insurance to the OFW or dependents.

What is the amount of life insurance?

*Maximum benefit amount of PHP 1MM for natural death at PHP 2MM for accidental death.

The Free Life and Accident Insurance is underwritten by Generali Pilipinas Life Assurance Company, Inc. / Generali Philippines. It is not a bank deposit or obligation of, or guaranteed by BDO Unibank, Inc. (BDO) or the Philippine Deposit Insurance Corporation. BDO is not in the business of offering or issuing insurance and nothing in this form shall be

interpreted as to acknowledge that BDO engages in the insurance business.

FEATURES

SERVICE FEES & CHARGES

CUSTOMER BENEFITS

Am I qualified to open Kabayan Account?

Program Mechanics:

a. At least six (6) remittance transactions

b. Average Daily Balance (ADB) of at least PHP25,000 (maintained in your account), which is easy to maintain when you save through your BDO Kabayan Savings Account

How Do I enroll For BDO Kabayan Savings Account?

To qualify remitters of BDO Kabayan Savings Account, enroll the account in Free Life and Accident Insurance now!

The enrollment is to be done online, however you may ask the nearest BDO branch to assist you on this. It is advised to bring ID or passport if you will be opening an account. |

Another bank in the Philippines that offers FREE life insurance is BPI's Pamana Savings Account the Pamana Savings Account is also available in BPI Family Savings Bank.

ELIGIBLE PARTICIPANTS. A BPI Pamana Savings Accountholder shall be eligible for a free life insurance coverage, provided the accountholder is at least 15 years old, but not more than 60 years old at the time of account opening, and his/her place of work and/or residence is not in the list of the areas or places restricted by the Company per the relevant Master Policy.

Am I Qualified To Open Pamana Savings Account?

What Is The Amount Of Life Insurance?

AMOUNT OF INSURANCE. The Amount of Insurance shall be equal to the lower of:

a)(ADB x3) three times the account’s average Month-to-Date Average Daily Balance (MTD-ADB) of three calendar

months immediately preceding the death of Insured Individual; or

b)P 2,000,000 for BPI Pamana Savings Account (Peso) or US$ 40,000 for BPI Pamana Savings Account

(US Dollar),

For more information about the FREE life insurance of BPI Pamana Savings Account you may check here.

What Is The Required Deposit, and Interest Rate of BPI Pamana?

For BPI :

Pamana Savings is also available in BPI Family Savings the details are as follows:

Where Can I open Pamana Savings Account With FREE Life Insurance?

You can visit any BPI (Bank Of The Philippine Island) or

BPI Family Savings Bank branch near you.

They will ask you for an ID or passport.

Upon enrollment they give insurance certificate for your FREE LIFE INSURANCE.

©2016 THOUGHTSKOTO